Planning for succession

When Neal Schwarzberger was in college, he learned what’s known as the “three-generation rule” and it resonated with him as the inheritor of ABM International, Inc., a quilting machine manufacturing business.

Often called the “shirtsleeves to shirtsleeves in three generations” adage, the principle states that most family businesses won’t survive the third generation. In other words, just as the inheritor’s grandparent started the businesses with nothing but the shirtsleeves they were wearing, the inheritor will end up with nothing left but shirtsleeves.

Meet ABM International, Inc.

Founded: 1947

A four-generation family business

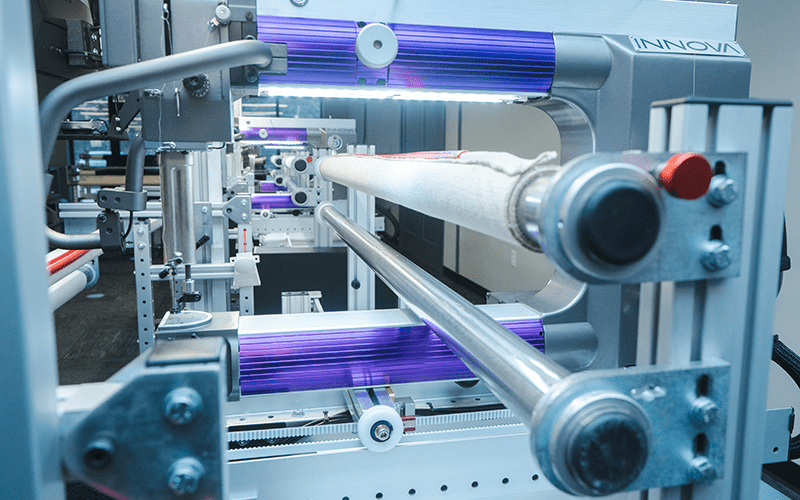

Neal’s grandfather, Arthur Schwarzberger, started the business from his garage, where he invented the first large-format sewing machine that could do crossover stitches. He initially called the business AB Industries, by combining the initials of his first name and his son Barry’s. In 1947, he renamed the business ABM industries, after his son Michael (Neal’s father) was born. After Arthur died, Barry and Michael assumed full responsibility of the company. Neal grew up working in the business, spending all of his school breaks there, and became president in 1996. He plans for his nephew, Ryan Israel, to someday succeed him.

How they made their mark

For most of its existence, ABM’s clients were U.S. textile mills making bedspreads, comforters and mattress pads. Today, its clients include some of the largest aerospace, automotive, boat and RV manufacturers, as well as home hobbyists.

“I remember saying to myself, ‘Well, I’m a third generation.’ I knew the odds were against me,” Schwarzberger recalled. But he has beaten the odds—and then some. Today, Schwarzberger has plans to one day successfully pass down the business to his nephew Ryan Israel, who is already working in the company as a salesperson. Making it to the fourth generation of ownership is a feat that as few as 3% of family businesses accomplish, according to figures compiled by Cornell’s SC Johnson College of Business.

So, how did Schwarzberger do it? He saw what many third-generation family business owners were missing: reinvention. “You can’t keep doing stuff the same way. After 70, 80 years, it’s impossible,” he said.

From the windy city to the lone star state

For Schwarzberger and ABM International, reinvention meant picking up the business—and, with it, his entire family—to move from Chicago to the Houston area. The move initially was part of ABM International’s downsizing—though, with Bank of Texas’ financing, it would later lead to the company’s growth surpassing even Schwarzberger’s expectations. For instance, the company’s new home would later yield a previously untapped market for ABM International—home hobbyist quilters. Quilting is much more popular in the South than in ABM’s former home of Chicago. In fact, Houston is home to the largest annual quilt show each fall in the U.S.

But Schwarzberger had no idea of the success to come when, after being in the business his entire life, he became president of ABM in 1996, a time when the textile industry was moving out of the U.S. overseas to countries like China and India.

Given that historically ABM’s largest clients were textile mills making bedding, the closure of many U.S. mills was a major blow for the company. “There was a decade of downsizing, adjusting, shrinking and survival mode,” Schwarzberger recalled.

But then opportunity came knocking. First, it was a call from General Motors; they were looking for a machine that could stitch car headline (the interior roof of a car). Then, calls came in from marine boat, airplane and RV manufacturers—all looking for machines that could stitch interiors.

An ally for all your expansion needs

ABM International’s third evolution—this time, not in name but in client base—meant the company needed more space to meet demand. Fortunately, the company already had purchased 30 acres of land in Montgomery, a small town around 55 miles north of Houston. ABM built five warehouses there, and then planned to expand operations by constructing a two-story office building—but that would take a construction loan. That’s where Bank of Texas came in.

The Houston commercial banking team at Bank of Texas, sat down with Schwarzberger, learned what ABM was seeking to do and then set out to help get it done. “Neal’s a no-nonsense kind of guy. He wants to get things done, and we were able to make it happen,” said J.W. Parnell, commercial banking market team leader.

In February 2018, ABM was approved for a construction loan to start work on the company’s new headquarters—but the project proved to be more time-intensive and costly than what was anticipated. ABM went through three builders; the project took a year longer than expected and went 50% over budget. Bank of Texas approved a second construction loan for a total of more than $1.1 million.

Today, Schwarzberger said he appreciates the confidence that Bank of Texas gave him, even when it became apparent the project would go over budget. “Bank of Texas stuck with us on the project and didn’t make me go find some other lender. They believed in it; they believed in us. They helped us see it through,” he said.

“Bank of Texas stuck with us on the project and didn’t make me go find some other lender. They believed in it; they believed in us. They helped us see it through.”

Neal Schwarzberger,president of ABM International, Inc.

Looking forward to the next generation

Schwarzberger says he never dreamed ABM International would achieve the level of success it has now. “I have to pinch myself some mornings because I can’t believe how far we’ve come. It has absolutely been the most incredible journey ever,” he said.

His two daughters are pursuing careers in medicine and law, so he s looking forward to his nephew Ryan someday taking ABM’s reins. “I just look at the way the landscape of the world has evolved in my short lifespan, and I can’t believe I actually was able to pivot, maneuver, change and grow this business again. We’re now set to certainly operate the next 30 or 40 years off of the work I’ve done.”

And Bank of Texas has become part of journey, too. “It’s not just a transaction. I’m not there to just discuss business. I want to have a relationship with my clients,” said Erik Olson, commercial banking Houston market manager at Bank of Texas. Like Parnell, he also is on the Bank of Texas team working with ABM. In Schwarzberger’s words: “It’s been great to allow you guys to become part of our family.”

“It’s not just a transaction. I’m not there to just discuss business. I want to make a relationship with my clients.”

Erik Olson,Commercial Banking Houston Market Manager at Bank of Texas

3 tips for a smooth business transition

Transitioning your business, such as passing it down to a family member, can be a confusing and scary process. Here are three ways you can make your transition smoother:

- Be aware of all the options: Some business owners plan to transition their business to a chosen person such as a family member. Some choose a third-party sale. Additionally, other options are available. For instance, some owners choose to give their employees ownership interest in the company through an employee stock ownership plan, commonly known as an “ESOP.”

- Have a documented succession plan in place: Be aware that drafting such a plan can be a lengthy process that may involve the collaborative work of business transition advisors, CPAs, state attorneys and corporate attorneys.

- Communicate your succession plan to your employees: Remember that your business likely is your employees’ livelihood. They don’t need to know all the details of your succession plan, but being aware that one is in place will help them feel more secure.

Bank of Oklahoma has a business transition services group that is entirely dedicated to helping business owners find the planned exit strategies that are right for them.

More success stories

-

Keeping their cool

Keeping their coolFlexible banking arrangements helped Summit Refrigerants take a “no-sweat” approach.

-

Keeping risk minimal

Keeping risk minimalAn IntraFi® Network Deposit helps United Way keep community funds safe and available.

-

Making a splash

Making a splashHow an SBA loan helped TNT Group cope with financial challenges to grow their pool business.