Asset Based Lending

Maximize Your Borrowing Capacity

What Is Asset Based Lending?

Asset Based Lending is an attractive financing option for companies looking to maximize their borrowing capacity. These secured revolving lines of credit of between $5 million to $50 million are based on the quantity and quality of accounts receivable and inventory. When does ABL work best?

- Prioritizing top-line growth versus bottom-line profitability

- Capital (leverage) to fuel expansion efforts

- Sponsor owned (PE) or pursuing a similar strategy

- Senior financing for initial LBO

- Management buyouts

- Mergers and acquisitions

- Recapitalization/restructure

- Declining trends/distress

- Commodity price fluctuations

- Seasonal/cyclical pressures

What Differentiates Us?

We are specialists in understanding your collateral and apply this expertise to unlock borrowing capacity for your company. Our ABL portfolio managers take the time to understand the needs of every client and are committed to doing what is best for them. It is this commitment to the relationship combined with our industry expertise that sets us apart.

- Relationship driven. Our dedicated ABL portfolio managers, in tandem with our local relationship managers, know our clients personally, advocate for their best interests and provide a level of service that is uncommon in our industry.

- Efficient and Responsive. Our structure is purpose-built, allowing us to react quickly to both new credit requests and changes from our clients.

- Industry Expertise. We have the expertise to handle and syndicate the most complex ABL capital structures in the market as well as the ability to deliver market-leading solutions to less complicated single-lender transactions of various sizes.

- Flexibility. We are committed to providing creative capital structure solutions to solve our client’s problems. We understand that a key aspect of a great partnership is the ability to be flexible.

Who Is Ideal for ABL?

Asset Based Lending can be a great financing solution and here is a list of those businesses or industries that best fit an ABL facility.

- Distribution

- Manufacturing

- Food and Beverage

- Retail

- Logistics

- Energy

- Service

- Equipment Rental

News and Insights

Scammers target generous givers

4 tips to stay vigilant and protect your donations and your information

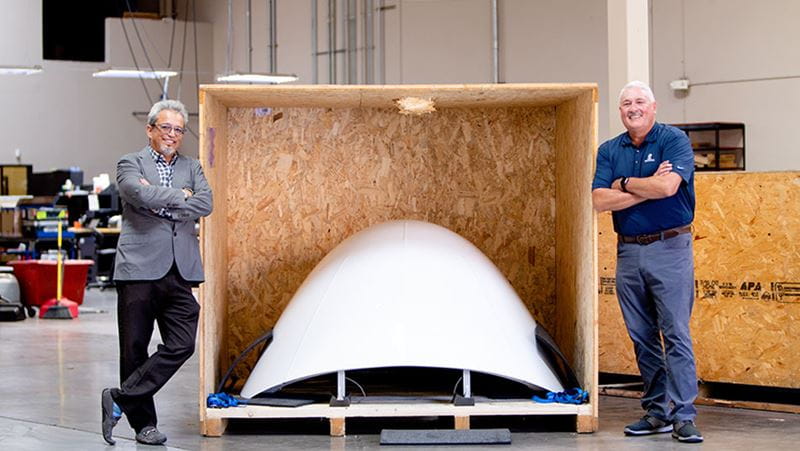

International aerospace company keeps travelers in the air

BOK Financial helps aircraft parts supplier soar to new heights

New scam alert: SIM swapping on the rise

Recent Asset Based Lending Business