Revolving Lines of Credit

The Easiest Way to Get Funds for Your Business

What's the easiest way to get cash for your business? A revolving line of credit with Bank of Oklahoma. You can have quick access to advances, any time.

Our Most Convenient Business Loan

Bank of Oklahoma revolving line of credit is a great way to quickly access cash when your business needs it. You can simply make an advance on your line of credit for whatever your business needs, whenever you need it. And with our one-time approval, there's no need to reapply each time you need additional funds. Just get an advance on your approved credit line at your convenience.

-

Balance Seasonal Cash Flow

Does your business ebb and flow with the seasons? A revolving line of credit can help keep you moving forward during slow periods so you can balance your business all year long. -

Take Advantage of Opportunities

You'll never have to turn down a business opportunity for lack of funds. With a revolving line of credit, you'll have access to cash quickly, no matter what your business needs. -

A Loan With A Lot of Flexibility

Not only will you get flexible repayment options, but you can also attach your line of credit to Overdraft Protection, so you don't have to worry about an overdraft affecting your business checking account.* -

Secure a Fixed Rate

Do you need access to a line of credit but want the security of a fixed rate on your advances? BusinessLock is the solution to break up your line of credit balance** into fixed rate term loans with consistent monthly payments.

Ready to Get Started?

Articles and Resources

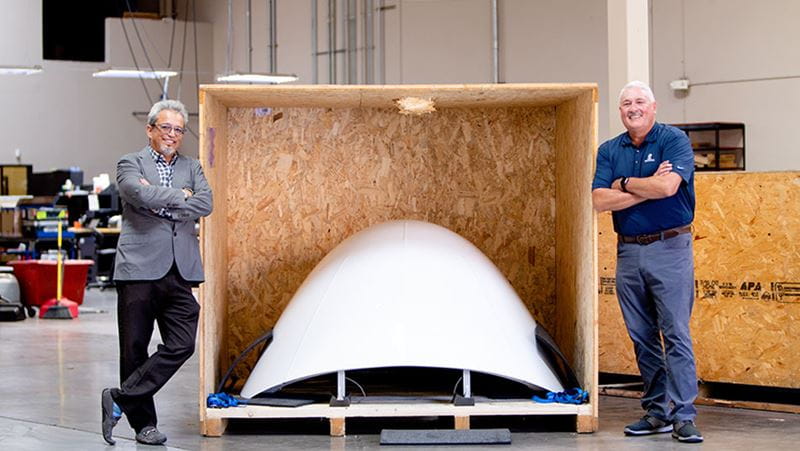

International aerospace company keeps travelers in the air

BOK Financial helps aircraft parts supplier soar to new heights

Ranks of debt-laden companies growing, amid high rates

Resilience key to company success

*Maximum line of credit amount for overdraft protection is $250,000.

**Subject to credit approval. Maximum line of credit for BusinessLock is $250,000. Minimum amount required to lock is $5,000. Lock Terms range from 12 - 60 months. Maximum of three locks can be outstanding. Account must be open and in good standing to process a lock request.